Today’s age is defined by digital connectivity, and the telecom industry stands as the backbone of the modern communication infrastructure. The evolution of telecommunications has witnessed several remarkable inventions, right from the traditional landlines to the cutting-edge 5G networks of the modern day. Through this blog, we will take a deep dive into the broad terminology of telecommunications, understanding the telecom industry’s growth, market status, growth-driving factors, challenges, and opportunities.

A Glance at the Telecommunications

Telecommunication facilitates the transmission of information over long distances by leveraging electronic and electromagnetic means. The simplest example is making a phone call. Here, voice is converted into electrical signals and transmitted through cables or wireless networks. It is then converted back into sound so that the receiver hears the message. This is just one example of telecommunication.

From sending an email, doing videoconferencing, watching a movie online without downloading the entire file, and even sending a text message, telecommunication enables us to stay connected, conduct business, access information, engage in social activities, and do a lot more.

In the telecom domain, internet connectivity and telephony requirements are addressed by three key services, which are:

- Fixed-Line Broadband

- Mobile Broadband

- Voice over Internet Protocol (VoIP)

The Fixed-Line Broadband technology delivers consistent and reliable internet access through physical cables like fiber optic or copper wires. According to ReportLinker, “The Global Fixed Broadband subscriptions are projected to reach 1.6 billion by 2026.”

The next category, i.e., Mobile Broadband, provides customers with internet access through cellular networks and offers flexibility and portability. As per The Mobile Economy Report 2022 by GSMA, “The Global mobile internet subscriptions are expected to reach 5 billion by 2025.”

VoIP makes use of Internet protocols to transmit data over a broadband connection. As per Allied Market Research, “The global mobile VoIP market was valued at $49.2 billion in 2021 and is projected to reach $327.5 billion by 2031, growing at a CAGR of 21.1% from 2022 to 2031.”

Telecom Industry Growth Analysis

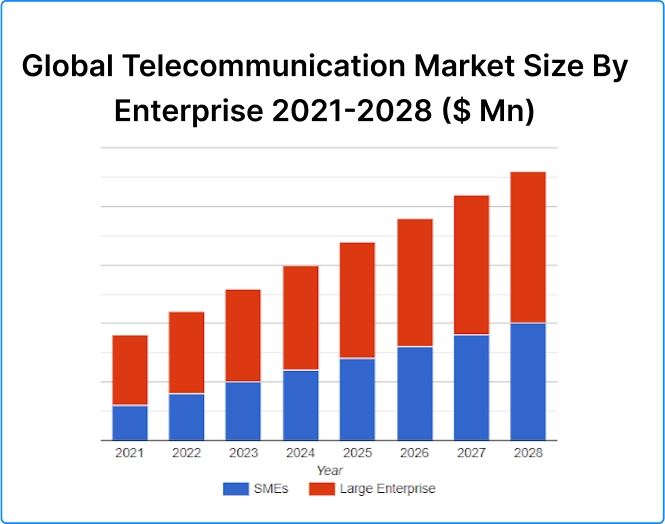

As the telecom industry facilitates communication and data exchanges across individuals and businesses worldwide, it has become a crucial pillar of the modern digital world. This industry is experiencing significant and consistent growth. Let’s delve into this growth with some recent statistics and figures.

Telecommunications Market Share – Global Market Value

The global telecom services market size is expected to reach USD 2,874.76 billion by 2030, according to a new study by Grand View Research, Inc. It is expected to expand at a CAGR of 6.2% from 2023 to 2030.

Telecom Industry Leaders: Global Mobile Network Operators

Let’s take a look at the key industry players, i.e., global mobile network operators, in the telecom domain.

T-Mobile US

- Revenue (2022): $84.3 billion (estimated)

- Net Income (2022): $14.2 billion (estimated)

A major telecommunications company, T-Mobile US, laid its foundation in 1994 as VoiceStream and was later renamed ‘T-Mobile USA’ in 2002. The company is headquartered in Bellevue, Washington, in the United States. The services offered by the company include wireless mobile phone services and data services.

China Mobile

- Revenue (2022): $114.4 billion

- Net Income (2022): $22.3 billion

Officially established in 2000, China Mobile is one of the largest telecom companies by market capitalization. It is headquartered in Beijing, China. Primarily, this telecom company offers mobile voice and multimedia services, data services, and fixed-line telephone services.

Comcast Corp.

- Revenue (2022): $106.5 billion

- Net Income (2022): $14.6 billion

Comcast Corporation was established in 1963 with its headquarters in Philadelphia, PA. The company delivers Xfinity-branded broadband, video, voice, wireless, and other services to residential and business customers. It offers the Peacock streaming service to some of its Xfinity internet subscribers for free. Comcast also provides direct-to-consumer options that include video, broadband, voice, and wireless phone services.

AT&T Inc.

- Revenue (TTM): $163.71 billion

- Net Income (TTM): $20.04 billion

Incorporated in 1989 with its headquarters in Dallas, Texas, the services offered by AT&T Inc. include wireless communications, data/broadband and internet services, local and long-distance telephone services, telecommunications equipment, managed networking, feature film, and television.

Verizon Communications Inc.

- Revenue (TTM): $135.65 billion

- Net Income (TTM): $19.29 billion

This telecom giant was incorporated via a merger in 2000 and is headquartered in New York. The services portfolio of the company includes wireless voice and data services and equipment sales, as well as data and video communications products and services, such as broadband video, data center and cloud services, security and managed network services, and local and long-distance voice services.

Deutsche Telekom

- Revenue (TTM): $124.19 billion

- Net Income (TTM): $8.11 billion

Established in 1995, Telekom has its headquarters in Bonn, Germany. Their line of services includes fixed-line telephone services, mobile communications services, internet access, and combined information technology and telecommunications services for customers in Germany, Eastern Europe, and the U.S.

Regional Telecom Market Research

The growth pattern of the telecom industry across different regions is significant but quite asymmetrical. Let’s take a look:

Asia Pacific

This region is expected to witness the highest growth. In 2022, the Asia Pacific captured more than 33.0% of the share and is expected to grow at a CAGR of 7.0% from 2023 to 2030. This growth is driven by various factors, such as the substantial rise in mobile phone users in the countries under this region including India, China, and Indonesia.

According to GSMA Intelligence, mobile subscriber growth in the Asia Pacific region is projected to reach 5.8 billion by 2030, representing over half of the global total. Additionally, the growing share of a young, tech-savvy population demands data-intensive services. Further, governments in these regions are actively investing in digital infrastructure, thus promoting digitization.

North America

With a well-established telecom infrastructure, North America presents a mature market with stable growth patterns. As per Statista, North America holds a significant share of the global market.

From 2019 to 2025, the number of mobile subscribers in North America is expected to increase by approximately 18 million. In 2025, it is expected that there will be approximately 341 million mobile subscribers in North America.

The region is among the first to deploy 5G networks, thus generating opportunities for new services and applications. Telecom companies in the North American region focus on value-added services like offering bundled packages and innovative solutions based on cloud computing and security services.

Europe

This region is experiencing moderate growth. The reason for this type of growth pattern is due to a high degree of market saturation. As a result, companies in this region are focusing on consolidation, i.e., merging, to compete effectively in this saturated market. When it comes to innovation in network technologies like MVNOs, European telecom companies are leading the way.

Africa and Latin America

With a large segment of the underserved population, Africa and Latin America are emerging markets with high growth potential. These regions have a limited fixed-line infrastructure, which makes mobile connectivity a primary driver of internet access. According to GSMA Intelligence, in 2021, Africa had a mobile penetration rate of around 47%. In addition, GSMA forecasts that the number of unique mobile subscribers in Africa will reach 570 million by 2025. Source

Latin America boasts a higher mobile penetration rate compared to Africa. As of 2022, GSMA estimates the region has a penetration rate of around 70%. Another key growth driver in these regions is the increase in investment by government and private companies in digital infrastructure.

Challenges in the Telecom Sector

Despite its continual growth, the telecom industry faces several challenges, as mentioned below:

-

The Investment Delimma

The 5G rollout brings several promising advancements; however, the ‘investment dilemma’ is a major challenge. Companies need to invest a substantial amount of capital in 5G infrastructure development. This can exhaust a major chunk of resources and impact profitability, making it a major consideration for smaller and regional telecom operators with limited resources.

-

Regulatory Hurdles

As the telecom landscape is evolving, so is the regulatory environment that surrounds this industry. This highly regulated environment presents telecom operators with a complex and challenging task they need to navigate. Some of the key aspects that pose significant challenges are:

-

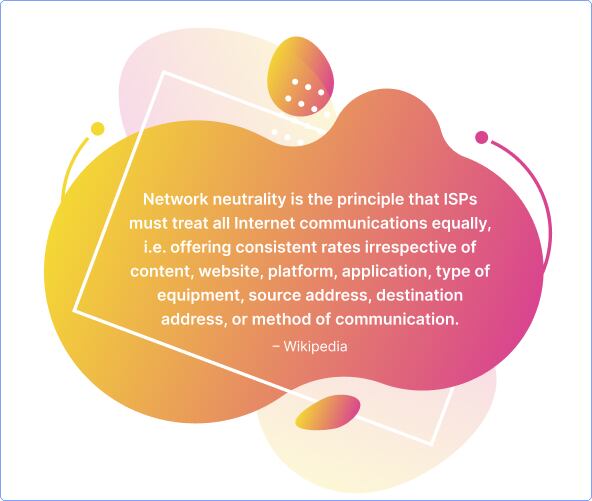

Net Neutrality

As per the Net Neutrality Regulations, ISPs need to treat all internet traffic equally, which poses another significant challenge for telecom companies. Compliance with net neutrality rules can limit the ability of telecom operators to implement differential pricing schemes, prioritize certain types of traffic, and offer specialized services, which can potentially affect their revenue and business models.

-

Data Privacy

With the implementation of GDPR, i.e., General Data Protection Regulation, in the EU region and similar frameworks emerging worldwide, telecom operators are bound to implement robust and the latest data protection measures. Investment in compliance efforts again adds a layer of complexity.

-

Spectrum Allocation

Telecom companies often need to actively participate in spectrum auctions allocated and managed by government agencies. This demands extensive financial resources, compliance with strict usage, and coverage obligations as defined in their licenses.

-

Cyber Security Threats

The telecom industry is more connected than ever before, however, this connectedness has given rise to cyberattacks, which pose a significant risk to the security and integrity of the telecom networks. According to The 2023 Cybersecurity Ventures Cybercrime Report, “The cost of cybercrime to the global economy is estimated to reach USD 10.5 trillion annually by 2025.”

Furthermore, according to Fortune Business Insights, “The global cybersecurity market is projected to reach USD 326.8 billion by 2027,” highlighting the growing need for robust security solutions. Data breaches can expose sensitive customer data as well as disrupt operations and damage the reputation of the brand.

Opportunities in the Telecom Sector – Key Growth Drivers

While challenges are inevitable, within these challenges lie exciting opportunities that can be leveraged to harness growth. Let’s delve into the ongoing trends in the telecommunications sector that act as catalysts for growth.

-

Shift Towards Digital Transformation

The ongoing trend of digital transformation is a key growth driver for the telecom industry. Businesses are switching to cloud services, solutions, and other digital tools to improve their operations and deliver top-notch services. This adoption drives demand for telecom services that support the necessary infrastructure and connectivity.

-

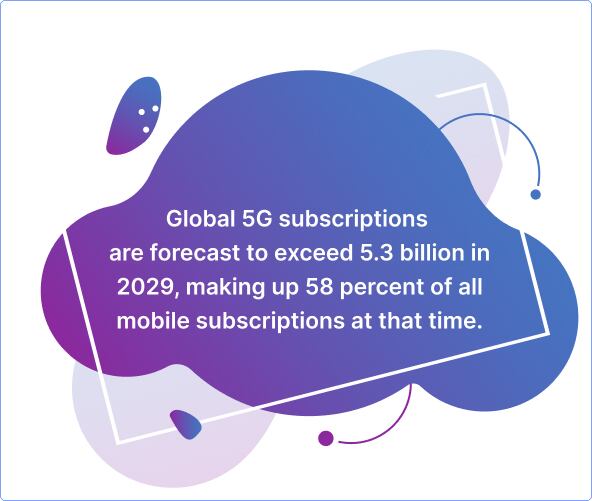

Rapid 5G Technology Adoption

There has been a strong focus on the rollout of 5G, with the number of 5G subscriptions worldwide set to double between 2022 and 2024.

The arrival of 5G has opened doors to a myriad of opportunities for telecom operators. 5G offers much faster speeds (up to 20 Gbps) with less latency (less than 1 millisecond) and more simultaneous device handling capacity. All these advantages of 5G are of very high value in innovative applications and services, including AI, ML, and IoT. Telecom operators can leverage the opportunity to capitalize on the growing demand for 5G.

-

Rise in Mobile Data Demand

The adoption of smartphones, tablets, and other connected devices has gone through the roof. With this, consumers rely on data-intensive services like streaming videos, online gaming, social media usage, etc. As per Cisco, “Global mobile data traffic is estimated to grow at an annual rate of around 55% in 2020-2030 to reach 607 exabytes (EB) in 2025 and 5,016 EB in 2030 (Source).” This surge necessitates telcos investing in infrastructure upgrades to provide customers with higher internet data speeds and capacities.

-

Internet of Things

The proliferation of IoT presents another exciting opportunity for telecom operators. IoT devices, whether they are smart home appliances or industrial sensors, rely on internet connectivity for their seamless working. Telecom operators can leverage this opportunity to provide IoT connectivity solutions tailored to various industries, such as manufacturing, healthcare, transportation, etc. This can be in the form of IoT connectivity platforms, management tools, and other value-added services.

-

Focus on Bridging the Digital Divide

The World Bank estimates that 2.9 billion people worldwide remain unconnected to the internet, emphasizing the need for continued efforts to bridge the digital divide. According to Grand View Research, “The global digital transformation market size was estimated at USD 880.28 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 27.6% from 2024 to 2030.”

-

Emphasis on Customer Experience & Personalization

Customers are the topmost priority for every sector today, and the telecom industry is no exception. Telcos focus more on delivering superior customer experiences and customized services to stand out. Tailored pricing plans, self-service options, and proactive customer support are some key areas that telecoms emphasize.

Conclusion- Telecommunication Industry Outlook

The telecommunications industry is poised for continued growth. We have explored the key opportunities and challenges, along with the developments that are shaping the future of the telecommunications sector. Technological advancements like 5G, Edge Computing, AI, and bridging the digital divide pave the way for a connected, sustainable, and inclusive future for all.

We can expect advancements like smart cities, industrial automation, and telemedicine. Besides 5G, AI, Automation, and Metaverse are also set to reform the telecom landscape. According to Emergen Research, “The global market for AI in telecommunications was USD 1.70 Billion in 2022 and is expected to register a steady revenue CAGR of 41.4% reaching USD 54.51 Billion in 2032.”

This will give birth to advancements like highly optimized networks, personalized services, and enhanced security. The intensive deployment of edge computing paves the way for amazing advancements like autonomous vehicles and billions of IoT devices connected seamlessly.

However, despite this progress, some challenges or obstacles need to be addressed. Cyber security threats, evolving regulations, and the need to bridge the digital divide, and implement sustainable practices certainly require careful navigation.