According to the new study from Juniper Research by 2024, the operator voice revenue will fall by 45%, in the face of 88% growth in the total number of third-party OTT mVoIP users over the next 5 years. Most Telco operators have expressed concern about losing revenue to Mobile OTT players! Voice profit pools are declining, and operator text messaging is moving to VoIP-based Mobile OTT apps like WhatsApp, Skype, Viber, or apps by expert solution providers.

What’s exactly left for the operator is the data revenue in this OTT dominant market. However, Data doesn’t seem well poised to replace the lost revenue. Operators have no choice but to look for applications and content in the hope of generating new revenue streams.

Once a monopolist, mobile operators now have to share the market with OTT players. The threat to the traditional voice & messaging business of telco operators from communications apps that offer free calling & messaging using the internet is rising. With the growth of Mobile OTT, operators are finding it tough to manage and ensure customer experience in the traditional way.

How are Telecom Operators are Losing their Monarchy?

Let’s take an example; someone is using a 4G data plan with XYZ mobile operator through a smartphone that has GSM calls and SMS service. However, when the user instead of using the operator’s calling/messaging/data features, use Skype or any other VoIP service through Wi-Fi / LAN, that’s a huge loss for mobile operators. The main reason for this is voice call and SMS revenue used to be operators’ profit previously, which are now transferred to OTT players.

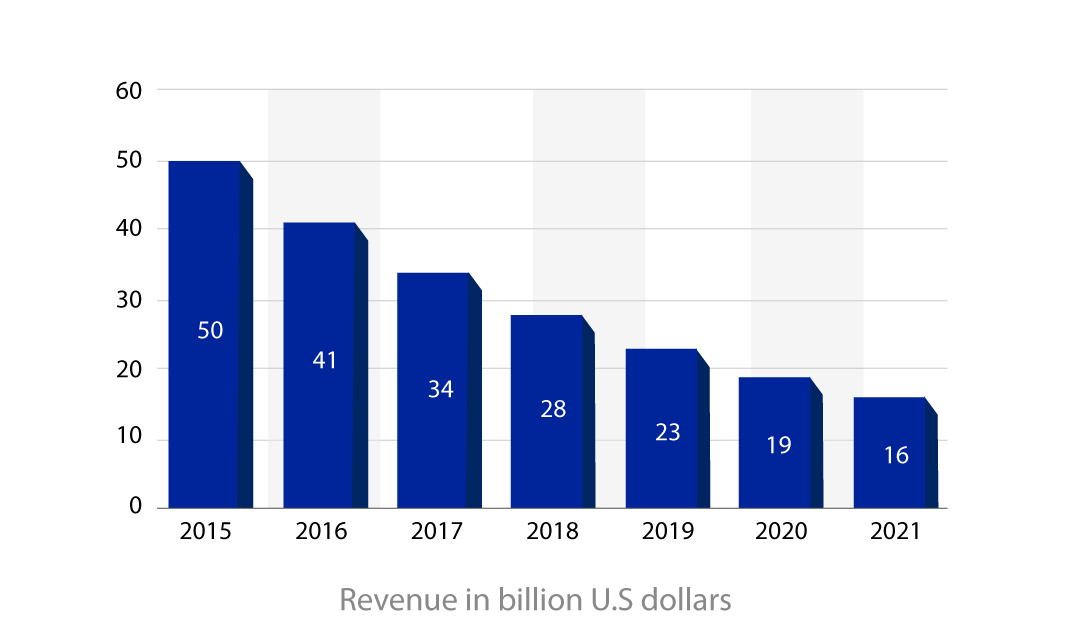

Mobile messaging revenue worldwide by carrier standard from 2015 to 2021 (in billion U.S. dollars)*

Source: Statista

Why Mobile OTT rather than Network Operator Service?

The rise of E-commerce, digital advertising, and digital media content, for instance, YouTube blogging, has benefited digital newcomers largely.

It’s not that telecom players haven’t added any significant new value, but at the end of the day telecom companies themselves have been unable to benefit and count their revenue.

Let’s look at what attracts OTT users & where telcos are lagging:

Free and Cheap Calls, and SMS with VoIP

VoIP is the most successful industry of the decade. Among its numerous benefits, it allows communicators to save a lot of money on both local and international calls, and on text messages. You now have services that allow you to use your smartphone with the underlying network to make free calls and send free text messages.

Geographical Limitation

The licensed provider can only serve their customers within their regulated dominion. OTT services, though, can serve any user anywhere in the world. For example, a network provider company users can make Voice calls and send SMS within the country at a cost-effective call rate but if they send SMS or make a call to long-distance, they will be charged sky-high rates! On the other hand, using mobile OTT apps they can make a long-distance international call at a very cheap rate. So obviously, users will prefer OTT apps.

Terms and Conditions

Unlike licensed network operators, OTT providers need not be subjected to a bundle of standards so, mobile OTT providers can provide services with a lot of freedom and relaxation.

Real-time Communication Experiences

While chatting with someone, if you can see the other person is writing you an instant reply that becomes a visual pleasure. Users can send cartoon emoticons or expression trolls like GIF keyboard to the person they are talking with, for expressing feelings, and send instant pictures while chatting. These features make the communication process more enjoyable instead of plain simple texting. Moreover, the joy becomes double when this whole pleasure comes in a cost-effective package.

How can Telco Survive?

Now the big question which will come to your mind is ‘How can Telcos survive in this scenario?’ A research titled ‘Mobile Voice: Emerging Opportunities for Operators and Vendors 2019-2024’ predicts that third-party OTT voice services will continue to increase nearing 4.5 billion users by 2024.

The study by Juniper Research stated that while this trend will add to declining voice revenue for operators, the growth of 5G will push several budding mobile voice and video services. Undoubtedly, this will create fresh revenue streams for service providers.

The study forecasts, by 2024, ViLTE (Video over LTE) operator revenue will cross $33 billion. For competitive voice service delivery, operators should capitalize on AI-enabled communications platforms. According to the report by Juniper Research, 5G proliferation will open new revenue streams for operators by allowing innovative use cases for VoLTE and ViLTE.

Some of the possible options for operators to regain the market include Unlimited Voice Packages, More Mobile Data, Internet Speed Upgrade, Additional Content Inclusion and Data Sharing. This strategy consists of wisely pricing up the market by adding up new services to existing bundles to provide a valid justification for the price increases. The objective is to capture as big a share as possible of the connectivity wallet – not just the individual subscriber but the whole family.

A common strategy adopted by some Telco companies is to approach OTT providers directly to secure individual content partnerships. Telecommunication providers have tried and mostly failed, to compete with OTT players. Can operators turn this situation around?

Telecom operators need to make considerable investments in upgrading their networks to handle the ever-increasing flood of data created by the very OTT players that are cannibalizing their revenue.

Few telecom operators have managed to build content and digital media franchises, yet these are still dwarfed by their core telecom businesses. Another option can be developing their own OTT app and serving their customer pools.

But no matter what, Telco OTT is the solution! In a wise viewpoint, while it may appear Telco and Mobile OTT apps compete with each other, they can still operate in a symbiotic relationship. Through the Telco OTT partnership, the main way operators are going to benefit from the relationship is by leveraging the massive amounts of big data that no one else can collect.

Read Also

Which Mobile OTT Features Let You Win Tough Market Competition

5 Ways to Create New Revenue Opportunities with Mobile OTT

Note: This blog is updated and reposted with important data on 24Oct 2021